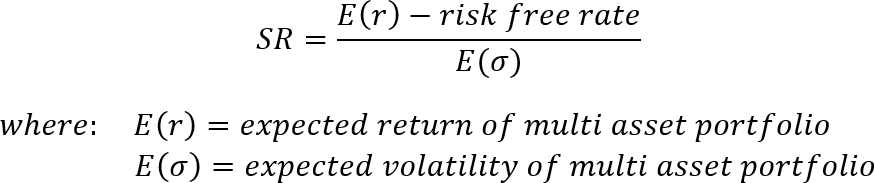

Asset allocation formula

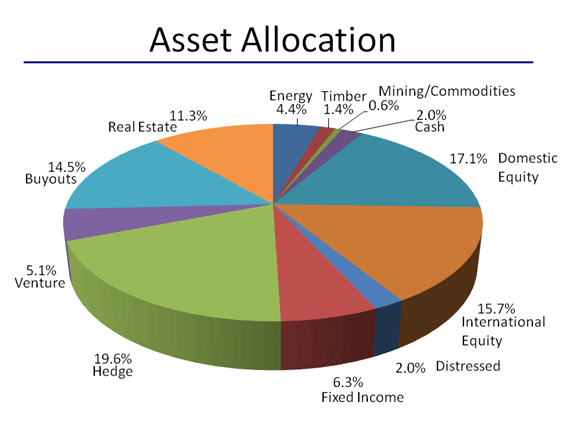

Asset allocation is the implementation of an investment strategy that attempts to balance risk versus reward by adjusting the percentage of each asset in an investment portfolio according. Low risk tolerance age in bonds.

Solactive Diversification The Power Of Bonds

Medium risk tolerance age minus 10.

. This article outlines how this system works and how investors use the formula to help in asset allocation. The quick way to calculate your bond allocation. Asset allocation is the primary determinant explains 936 of the variation of a portfolios return variability with security selection and market timing together active.

Ad Position Market Products Construct Portfolios And Analyze Mutual Fund Ratings. So for our case of SP 500 index f 16 or 1 in practical terms and the half Kelly is 16208. This is because the asset allocation in this type of portfolio is typically fairly well balanced between stocks and fixed income and cash.

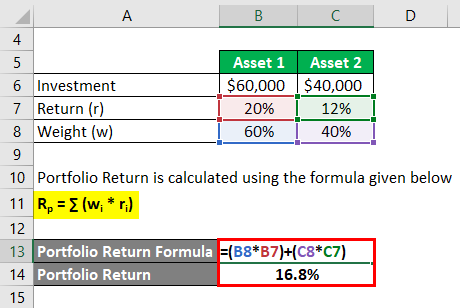

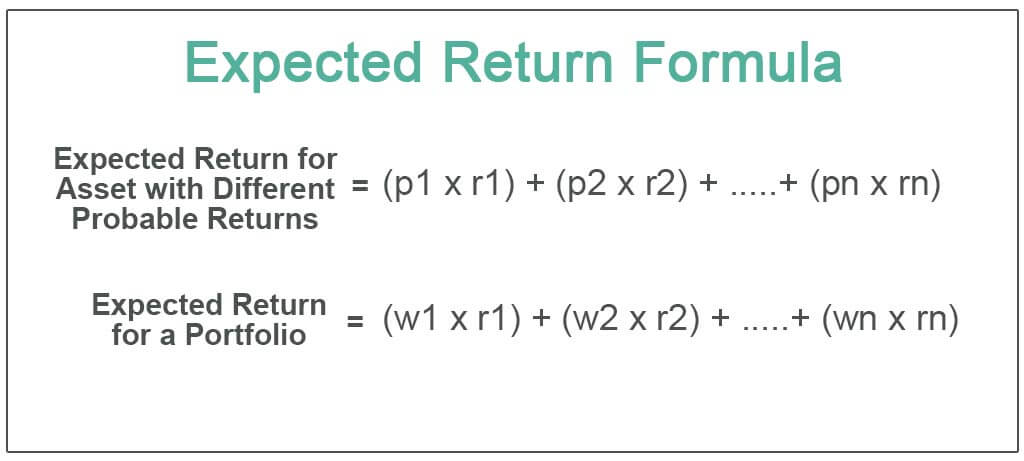

ER of portfolio 3 x 25 10. As a simplistic example Ill use. For each fund multiply the percentage that the fund represents in your portfolio by the percentage of the fund thats.

Ad Learn How Bank of America Private Bank Can Help You Explore Alternative Investment Options. Asset allocation is the value added by under-weighting cash 10 30 1 benchmark return for cash and over-weighting equities 90 70 3 benchmark return for equities. Allocation Effect Selection Effect 524 324 200 050 250 As we noted the investment decisions generated a positive excess return of 200 basis points bps relative to the.

EW_INDEX_MA Equal-weight monthly rebalanced across core 5 asset classes with 12-month moving average rule. Access Advisor Solutions proprietary wealth management technology. Ad Learn More About American Funds Objective-Based Approach to Investing.

The security selection return results from deviations from benchmark weights. With this strategy you constantly adjust the mix of assets as markets rise and. The asset allocation return is the result of deviations from the asset class portfolio weights of the benchmark.

If the investor allocated 25 to the risk-free asset and 75 to the risky asset the portfolio expected return and risk calculations would be. Even though the Kelly allocation produces on average higher ending wealth the. This system is also called the Kelly strategy Kelly formula or Kelly bet.

Investment Analysis Software Designed For The Way You Work Built On Data And Research. Another active asset allocation strategy is dynamic asset allocation. RANDOM ¼ random chance of moving to risk-free rate.

Strategic asset allocation is a portfolio strategy that involves setting target allocations for various asset classes and rebalancing periodically. Register to access Advisor Solutions proprietary wealth management technology. See How American Funds Can Help Improve Client Outcomes Through Objective-Based Investing.

High risk tolerance age minus 20. This portfolio might have an allocation in. The Asset Allocation Calculator is designed to help create a balanced portfolio of investments.

As a simplistic example Ill use. Age ability to tolerate risk and several other factors are used to calculate a desirable mix of.

Lower Risk By Rethinking Asset Allocation Seeking Alpha

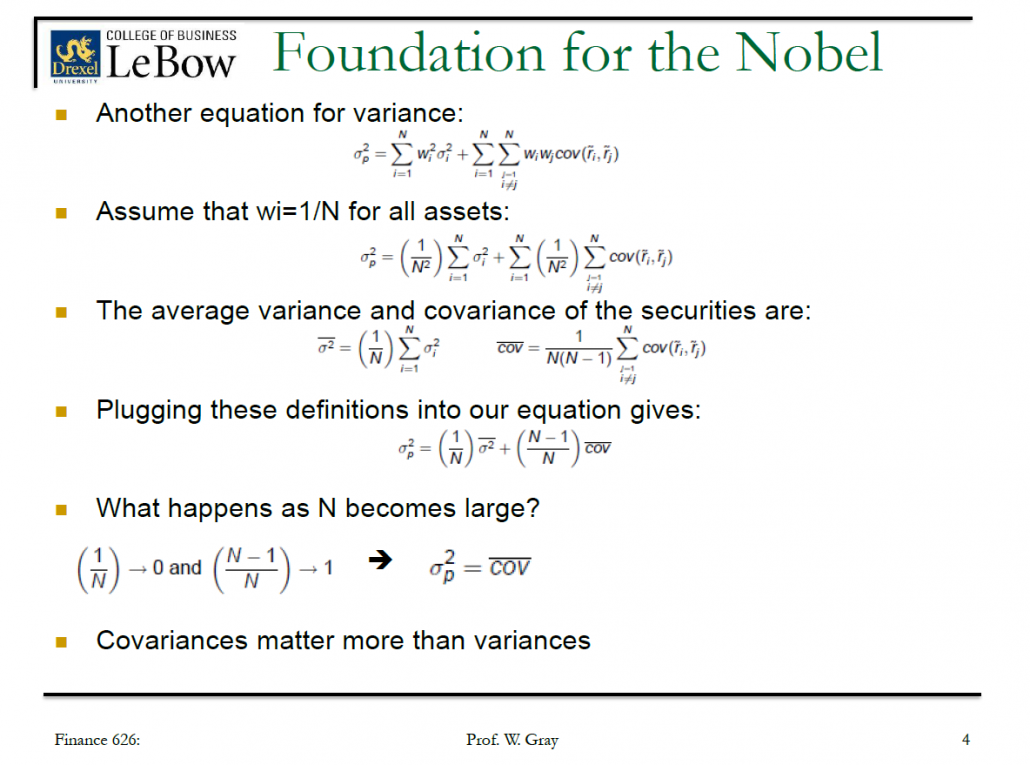

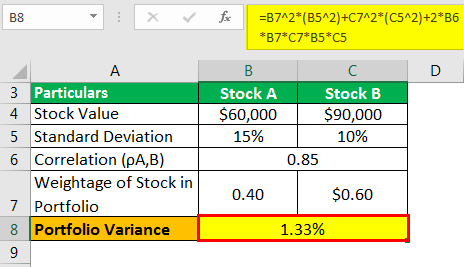

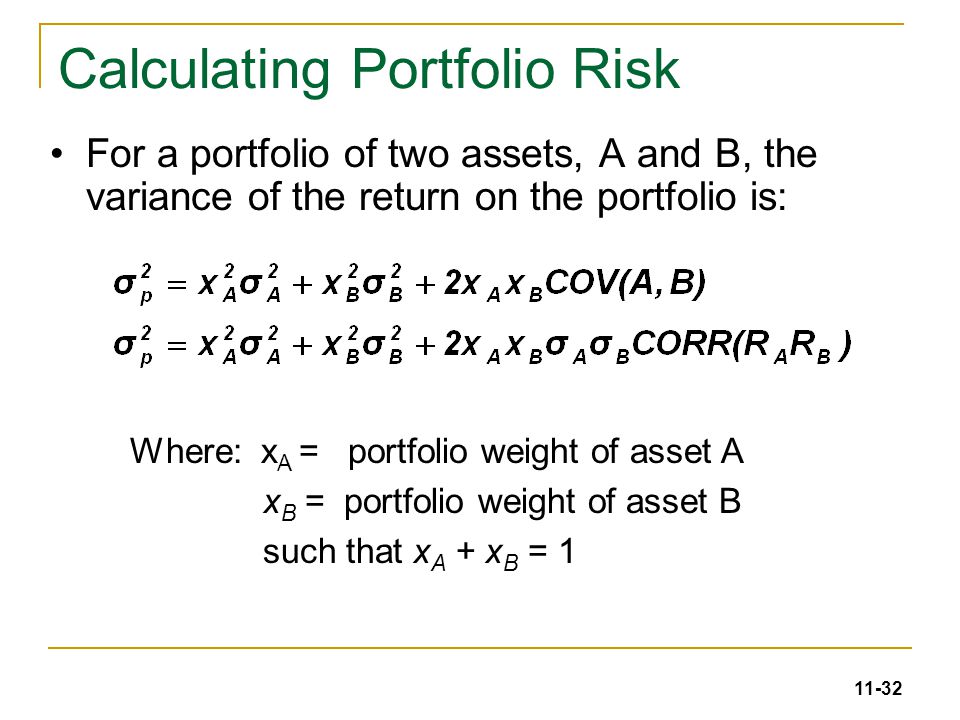

Standard Deviation And Variance Of A Portfolio Finance Train

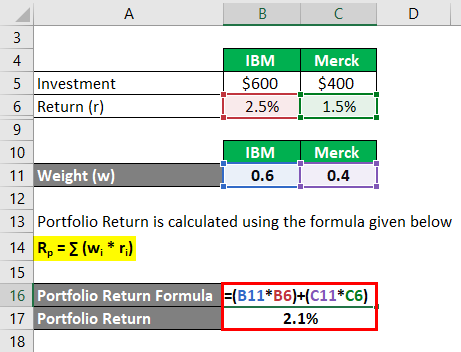

Portfolio Return Formula Calculator Examples With Excel Template

Portfolio Return Formula Calculator Examples With Excel Template

Chapter 5 Risk And Rates Of Return N

/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

How To Achieve Optimal Asset Allocation

:max_bytes(150000):strip_icc()/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

How To Achieve Optimal Asset Allocation

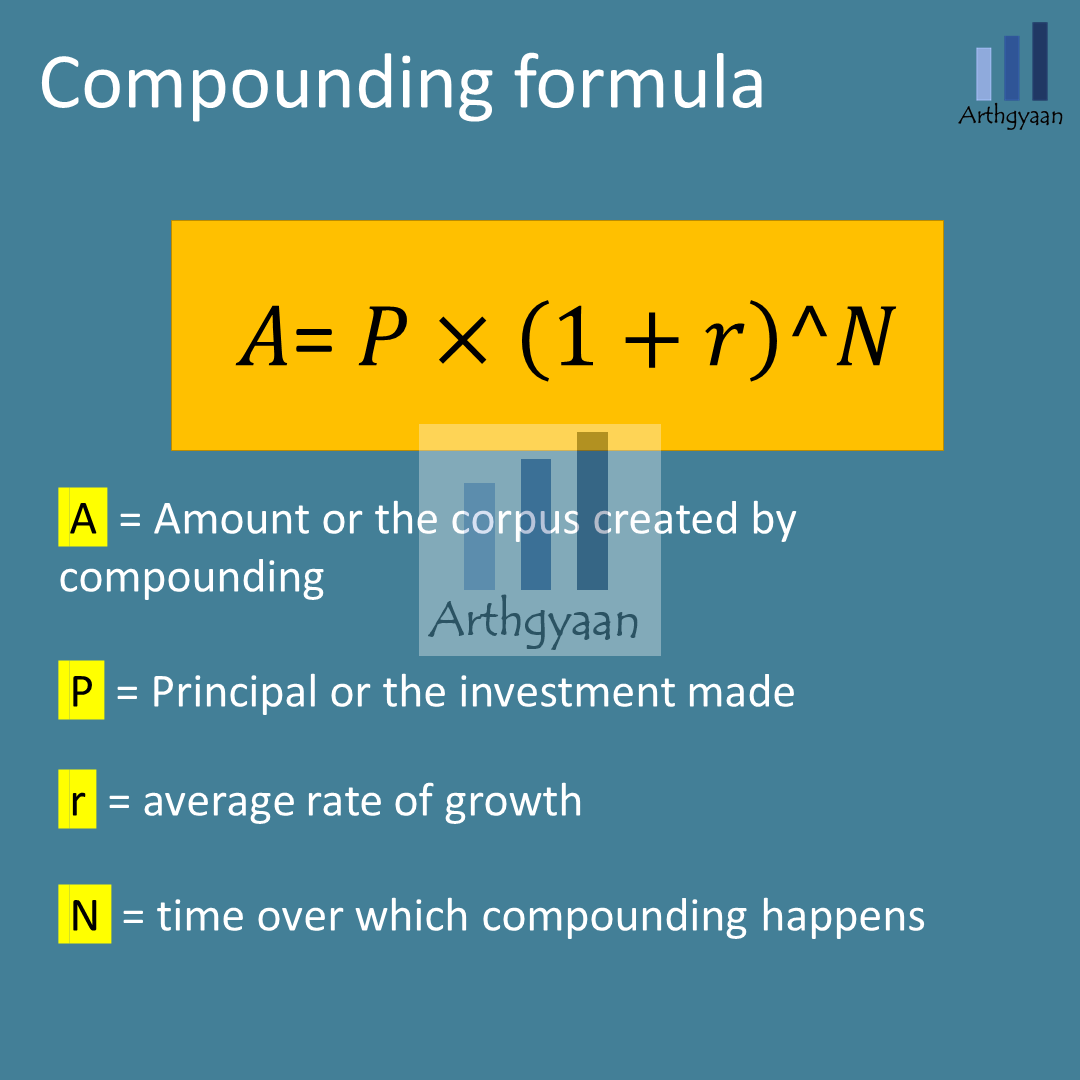

Portfolio Rebalancing During Goal Based Investing Why When And How Arthgyaan

Tactical Asset Allocation Beware Of Geeks Bearing Formulas

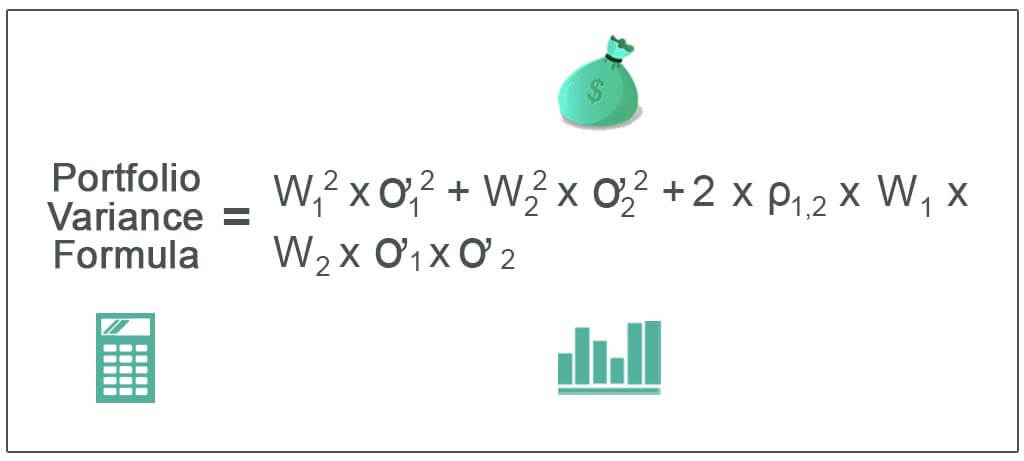

Portfolio Variance Formula Example How To Calculate Portfolio Variance

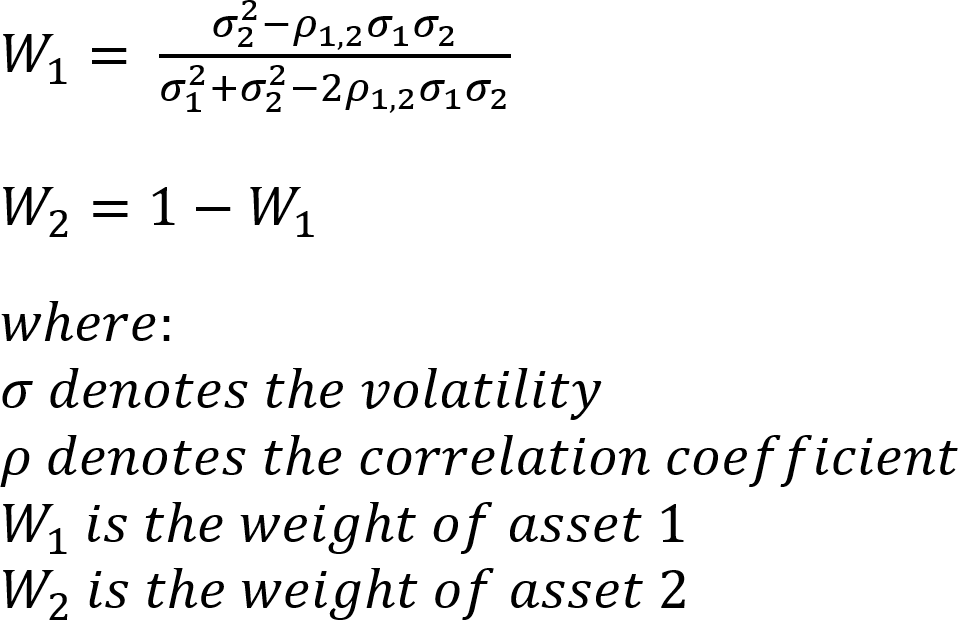

Optimization Formula For Optimal Portfolio Of 2 Assets When No Shorting Allowed Quantitative Finance Stack Exchange

Portfolio Variance Formula Example How To Calculate Portfolio Variance

Expected Return Formula Calculate Portfolio Expected Return Example

Diversification And Risky Asset Allocation Ppt Video Online Download

Asset Management Lecture 15 Outline For Today Performance Attribution Ppt Download

Solactive Diversification The Power Of Bonds

Portfolio Return Formula Calculator Examples With Excel Template